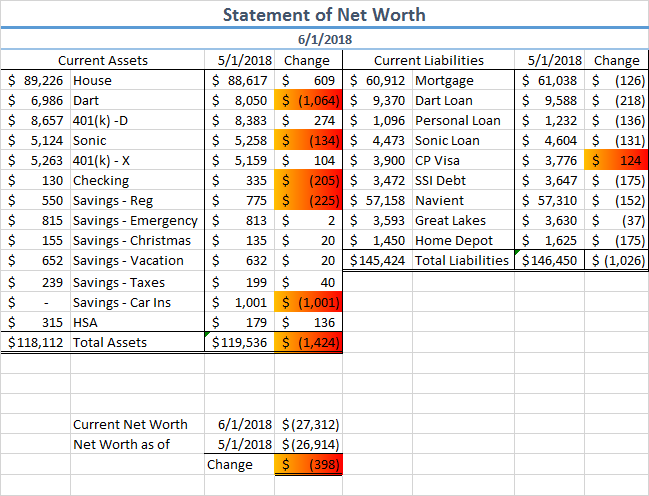

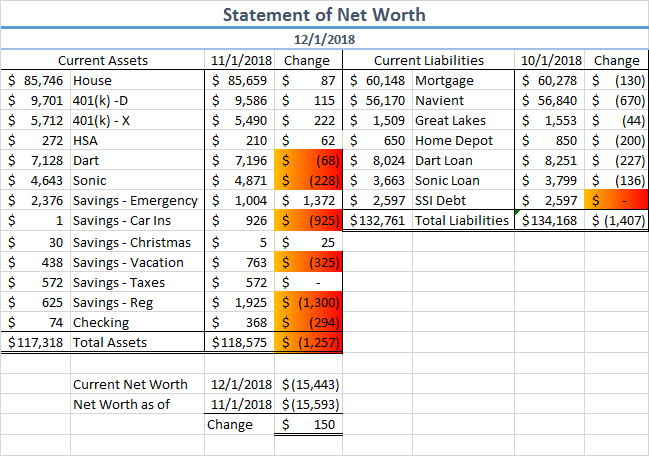

Hello, and welcome to our last net worth update for 2018! Boy, we have had some pretty big changes this month.

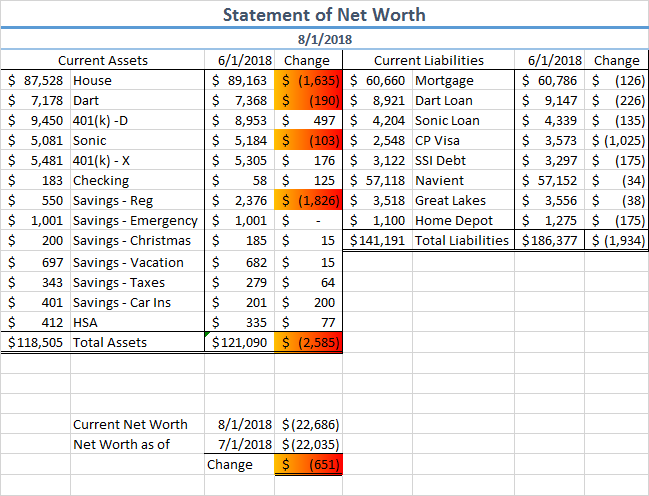

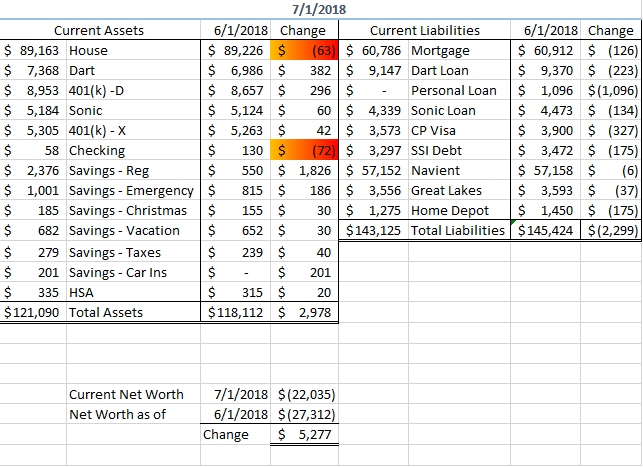

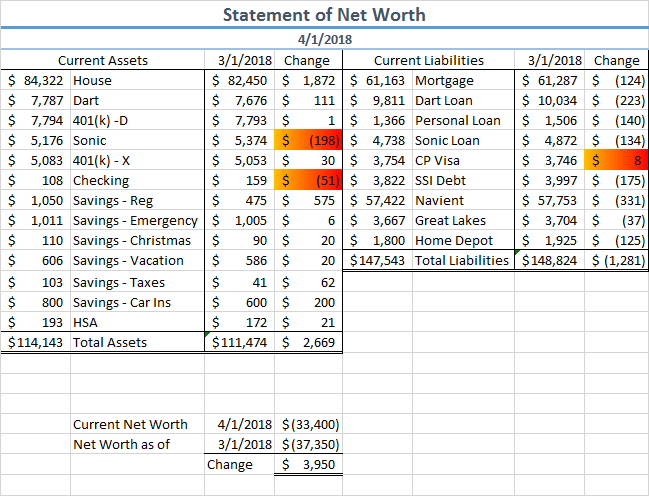

Assets

As if the unexpected change I will discuss below wasn’t enough, our assets decided to join in on the fun. So many decreases! There is one unusual increase however…

Savings – Emergency – You will notice an increase of $1,372. Instead of making a large payment to our smallest debt, we tucked the money in here instead. More about that later.

Car Insurance Savings – We paid our 6 month car insurance bill last month, so that’s the reason for the huge decrease in this account. When our car insurance is due, we charge it to our Capital One credit card for 1.5% cash back and then pay it off at the end of the month.

Vacation Fund – We withdrew $350 from here for our NYC trip last month, and then deposited $25.

Savings – Reg – We had what appears to be a drastic decrease of $1,300, but that is because our last update was late in the month. This account is our holding vessel for all our paychecks until the end of the month when we pay all our bills. Therefore, when I post updates late in the month, this account has a higher balance and impacts our net worth.

Checking – This decrease is just a regular fluctuation in our spending cash.

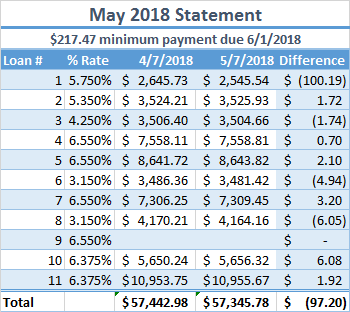

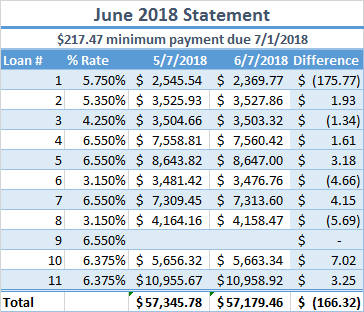

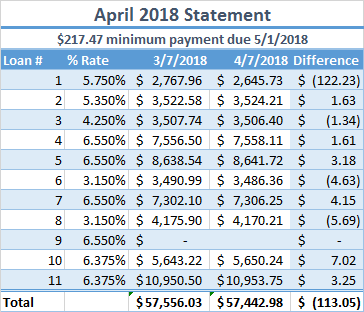

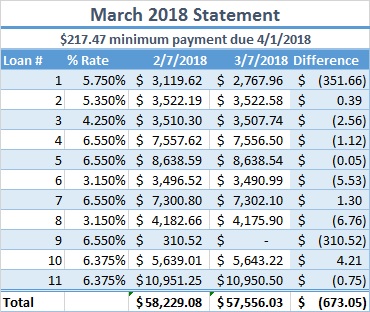

Liabilities

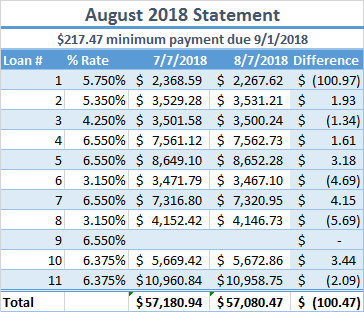

Navient – This account also ganged up on us during our struggle. We have an income based repayment plan that was due to reset November 1st. It did not. Navient sent a bill for $595.72 which is my standard repayment amount. I called to have this fixed, and the customer service rep corrected our automatic draft back down to $217.42. A couple of days afterwards I had 10 past due notices totaling $378.30 (the amount remaining from $595.72). I went ahead and paid the bill, and was told our automatic draft for December 1st would be fixed. It wasn’t. We paid $595.72 on this day as well. Finally, it is fixed for January 1st! Our new payment will be $307.86.

SSI Debt – Every month I call The Debt Management Department in Chicago to pay $100 for an over-payment on my son’s SSI that I received when he was a minor. The balance started at over $7,000 and we have gotten down to $2,600 in $100 monthly increments. However, I have not been able to get through the phone lines for the last couple of months.

Fortunately, the last time I actually did get through to someone he sent me an automatic payment form to fill out so I could have the payments deducted from my credit card automatically. I filled it out and sent it in, and to my delight last month I didn’t need to call because the payment came out on its own!

However, they have not drafted a payment since then and I cannot get through on the phone lines. They have the authorization to draft funds if they ever choose to. I’m not sure what I’m going to do with this account at all. I can’t get them to take my money!

Conclusion

We decreased our debts $1,407 this month, but due to the decreases in our assets, we only saw an increase of $150 for a total net worth of $(15,443). After the month we had, it’s a miracle we didn’t go backwards! Oh yeah, about that…

Planned Debt Pay Off/ Life Update

On November 29, one day before I would have sent that big payment to Great Lakes, my husband called to tell me he had just been fired.

I am so incredibly grateful it happened before November 30, because it would have been difficult, if not impossible, to try to reign that money back in. So, we paid our bills as we usually would and then everything left over went in to the emergency fund to help us ride out this storm.

X has been a trooper and took job searching as his new full time job. I encouraged him to take his time and really use this as an opportunity to find something that paid better, had better hours, and just made him feel proud to say he worked there.

Since we have been paying off debt, we have decreased our bills to the point where my income alone was almost enough to fully support us. We would be short about $75 per month, but whatever shortage we had would be drawn from the emergency fund. If necessary, this could have continued for months. That was a really comforting fact.

Every morning he got up, hit the job markets, applied like crazy, attended a bunch of interviews and finally on December 10th he signed an offer. He starts December 17th as a bilingual customer service rep at a local bank here in Michigan. It pays $2/hr more than what he made at his previous employer and there is lots of opportunity for advancement.

The timing still stinks, of course. December is still a one income month, and of course it’s the holidays which rubs a little salt in the wound. We will not be cancelling Christmas, however. Again, whatever we are short at the end of December will be drawn out of the emergency fund, and in January we will be a two income family again, and back to demolishing student loans!

Thank you, as always, for reading.

XOXO,

Dolores